Contents:

The period of consolidation is followed by a breakout and then a continuation of the ongoing bullish trend. Flags are breakout chart patterns, meaning traders wait for the price to break either an upper or a lower flag boundary, depending on the trend, to enter the market. While a bull flag validates that the preceding uptrend will continue, the bear flag ensures that the preceding downtrend is likely to occur. Bull flags are sharp rallies followed by a period of consolidation that forecast the breakout of an asset. Bear flags are sharp downturns followed by a period of consolidation that forecast the reversal of an asset. Price patterns such as bull flags and bear flags provide insight into what traders think and feel at a specific price level.

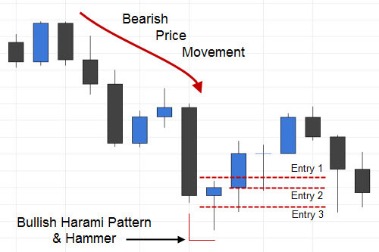

An increase or more than usual along with a downtrend indicates an increase in the seller’s desire for security. The entry point should be at the breaking point of the flag, while the stop loss order should ideally be below the price correction channel. The first profit limit should be the size of the flagpole. If the trend is strong enough, the movement continues. To manage risk, price movement above the resistance of the flag formation area is considered as the point of loss or failure level.

Diamond Bottom pattern explained

If the trading volumes rise after the correction and the price breaks above the bull flag’s upper boundary, it’s a sign of the trend’s continuation. When the price consolidates, the Volume indicator is expected to decrease as bulls aren’t strong anymore. Simultaneously, the upward breakout of the flag’s resistance will signal the strength of bulls, so the trading volumes should increase. In common words, the bull flag pattern appears due to a pause in the uptrend. It’s the time of price consolidation, after which the price continues to move up. The aim of this article was to study in detail the flag patterns, their main advantages and disadvantages.

An ashttps://g-markets.net/ usually mimics the pole after a bull flag breakout or bear flag breakdown. If support of the bull flag is breached, the trader knows the pattern is invalid and continuation is unlikely. More often than not, trends (bullish/bearish) will pause briefly to allow traders or investors who missed the initial move to join the bandwagon.

Pin bar: How to identify a liar?

In this article we look at how to trade these opportunities. The flag pattern is one of the most widely used continuous patterns in technical analysis that analysts use to identify the leading trend. In this article, we examined the details of the flag pattern and how to use it. In general, in technical analysis, when using flag patterns, it is better to pay attention to volume indicators and price movements so that the analysis is more reliable and less risky.

Bull Flag Breakouts in Nasdaq, Russell 2000 and S&P 500 Hit a … – Investing.com India

Bull Flag Breakouts in Nasdaq, Russell 2000 and S&P 500 Hit a ….

Posted: Fri, 17 Feb 2023 08:00:00 GMT [source]

However, once volume recedes into the pullback, the bull flag will overcome the selling pressure and break this counter-trend consolidation. A bull flag means that there is a pause, albeit brief, in the upward momentum of a stock’s move to higher prices. It indicates that the stock might be in a temporary overbought condition, which will likely bring in some early selling pressure in a young bull run. Regardless of which strategy you use, it is important to keep in mind that this pattern is best used in downtrends. There are a couple of different ways to manage this trade. The most common is to place a stop below the consolidation area.

A flag pattern is a correction within a strong trend. During the correction, the price should move slightly opposite to the main trend. If the price doesn’t exceed a 50% deviation from the overall trend, there’s a high chance it’s a flag pattern. Although the bull flag seems simple, there are some tips for trading this continuation pattern.

Bull Flag and Bear Flag Pattern Traits

A breakout to the upside activates the pattern, while a break of the supporting line invalidates the formation. The bull flag is an upside-down version of the bear flag. The initial sell-off comes to an end through some profit-taking and forms a tight range making slightly higher lows and higher highs. Determine significant support and resistance levels with the help of pivot points.

The high volume into the move lower and low volume into the move higher, are suggestions that the overall momentum for the market being traded is negative. This furthers the assumption that the preceding downtrend is likely to continue. A trading target from the breakout is often derived by measuring the height of the preceding trend and projecting a proportionate distance from the breakout level.

Your results may differ materially from those expressed or utilized by Warrior Trading due to a number of factors. We do not track the typical results of our past or current customers. As a provider of educational courses, we do not have access to the personal trading accounts or brokerage statements of our customers. As a result, we have no reason to believe our customers perform better or worse than traders as a whole.

- If the retracement is below 50%, it’s not a flag pattern.

- You can see that the market touched exactly this level, and then slightly corrected lower, which most likely points to take-profit orders of the bull flag being hit.

- CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

- One advantage is that it might give an accurate prediction, and a disadvantage is it might give an inaccurate prediction.

- In a bull flag formation, traders will hope to see high or increasing volume into the flagpole .

Provides traders with a signal on the continuation of the uptrend. A trading target of failure is often achieved by measuring the height of the previous trend and predicting the distance commensurate with the failure level. Now look for the continuation component of the flag when the prices begin to fall to continue the original trend. The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk – this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.

Citytradersimperium.com needs to review the security of your connection before proceeding. Please see the further, important disclosures about the risks and costs of trading, and client responsibilities for maintenance of an account through our firm, available on this website. Once you have selected the relevant trade pair, click on the Indicatorsbutton at the top of the chart and a new window will pop up. Input RSI in the search bar and you will find the indicator.

Trading a bear flag pattern

Speedbear flag vs bull flagr does not guarantee the accuracy of, or endorse, the statements of any third party, including guest speakers or authors of commentary or news articles. All information regarding the likelihood of potential future investment outcomes are hypothetical. This information has been prepared by IG, a trading name of IG Markets Limited. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

What is a bull flag chart pattern and how to spot it? – Cointelegraph

What is a bull flag chart pattern and how to spot it?.

Posted: Sat, 08 Oct 2022 07:00:00 GMT [source]

The chart above shows the bull flag on an hourly chart of the EUR/USD pair. A trader could open a buy position after the breakout candlestick or the second candlestick after the breakout . The second candle is bullish and long, which could confirm a trend continuation. Harmonic patterns are used in technical analysis that traders use to find trend reversals. By using indicators like Fibonnaci extensions and retracement… Lastly, be sure to analyze volume to determine the reliability of your bull flags.

We have no knowledge of the level of money you are trading with or the level of risk you are taking with each trade. HowToTrade.com helps traders of all levels learn how to trade the financial markets. The take profit is measured by simply copy-pasting the flagpole from a point where the breakout took place. Some traders prefer to use the starting point to copy-paste the trend line where the breakout move initially started i.e. within the body of the flag. While both are generally acceptable, we advise you to use the breakout point to copy-paste the flagpole. Our entry is located either at the close of the breakout hourly candle, or we wait for a retest, which can be tricky as the price action may never return to retest the broken resistance.

SpeedTrader does not supervise the third parties, and does not prepare, verify or endorse the information or services they provide. SpeedTrader is not responsible for the products, services and policies of any third party. Day trading is subject to significant risks and is not suitable for all investors.

- Research & market reviews Get trading insights from our analytical reports and premium market reviews.

- These patterns are helpful for traders who wish to take advantage of short-term and long-term market trends.

- Day Trading is a high risk activity and can result in the loss of your entire investment.

- A bear flag is identical to a bull flag except the trend will be to the downside.

- The flag is framed by trendlines, which serve as support and resistance levels.

You need to draw resistance and support lines through four points. Then a range forms from additional high and low points below the previous ones. The point of the strategy is to identify the optimal entry point with the help of a pending buy order. You can close the position based on the length of the flagpole.