Contents:

We also have CFOs on our team to assist you with business growth when you’re ready to make the most of your business’ potential. Call our Central Ohio office to speak with one of our team members about how we can help your small business. The second notation, usually used after the discount notation, means the net amount must be paid within 30 days or how many days you decide. A perfect way to demonstrate what this would mean is to show an example.

Best Accounting Software for the Self-Employed Top 5 in 2023 – Tech.co

Best Accounting Software for the Self-Employed Top 5 in 2023.

Posted: Tue, 28 Feb 2023 08:00:00 GMT [source]

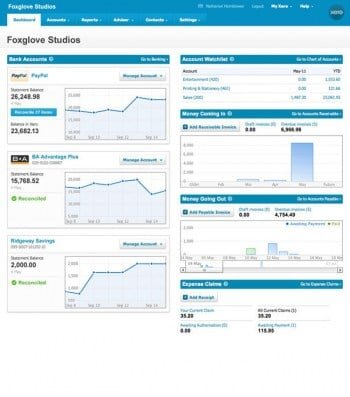

With FinancePal, you’ll have more control over your accounts receivable processes, all while spending less time on the administrative work. AP departments are responsible for processing expense reports and invoices and for ensuring payments are made. A skilled AP team keeps supplier relationships positive by making sure vendor information is accurate and up-to-date and bills are paid on time. The team can save the company money by taking full advantage of favorable payment terms and available discounts. A strong AP practice contributes to business success by ensuring cash forecasts stay accurate, minimizing mistakes and fraud and generating reports for business leaders and third parties. Outstanding advances are part of accounts receivable if a company gets an order from its customers with payment terms agreed upon in advance.

Accounts Receivable Example:

That’s why best barcode software for small businessants define accounts receivable differently than sales. The next step in this situation is to contact the customer or to move on with contacting a collections agency. It’s important to note that companies that sell on credit may not have an actual lien on the property.

The receipt of an accounts receivable item is typically reflected in a deposit made to your cash account. When you have accounts receivable, it is vital to review it before assigning revenue accounts to your deposits to make sure you remove any accounts receivable you have so you do not double count revenue. „Accounts payable“ refers to an account within the general ledger representing a company’s obligation to pay off a short-term obligations to its creditors or suppliers. Many businesses use accounts receivable aging schedules to keep tabs on the status and well-being of AR. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

Why Small Business Choose

The phrase refers to accounts that a business has the right to receive because it has delivered a product or service. Accounts receivable, or receivables, represent a line of credit extended by a company and normally have terms that require payments due within a relatively short period. It typically ranges from a few days to a fiscal or calendar year.

Conversely, this creates an asset for the seller, which is called accounts receivable. This is considered a short-term asset, since the seller is normally paid in less than one year. Accounts receivable bookkeeping is the accounting process of recording, tracking and reporting on the accounts receivable of a business. It is performed by an accounts receivable clerk or other bookkeeping professional and is a vital part of maintaining a business’s cash flow. And this process can only take off if you’ve implemented tight, detailed accounts receivable bookkeeping procedures. This will allow you to effectively review not only where your accounts receivable balance stands today, but also year-over-year trends and other key data points.

For many businesses that get paid through invoices or bills, accounts receivable is critical for understanding the overall financial health of your company. If your business invoices customers who will pay over time, then your business has accounts receivable. Here’s a quick guide to how to do accounts receivable accounting. Let’s say that Sue wants to buy a $3,000 gazebo but doesn’t have that amount at the time of the sale. During that time, the sellers would have $3,000 listed in their accounts receivable.

When you’re starved for sales, it can be tempting to loosen up the rules you have in place for extending credit to your customers . This is a short-term fix, usually causes more problems than it solves, and can take your company down a slippery slope. Following up on late customer payments can be stressful and time-consuming, but tackling the problem early can save you loads of trouble down the road.

We’ll manage your accounts receivable virtually from our office in Murray, UT

Some businesses will create an accounts receivable aging schedule to solve this problem. This means XYZ Inc. has an accounts receivable turnover ratio of 30. The higher this ratio is, the faster your customers are paying you.

Amy’s Bookkeeping Announces Small Business Accounting Solutions in Denton – Yahoo Finance

Amy’s Bookkeeping Announces Small Business Accounting Solutions in Denton.

Posted: Thu, 02 Mar 2023 08:00:00 GMT [source]

For example, the software can minimize the time and effort required to process invoices by eliminating manual entry and automatically calculating discounts. In terms of accounts payable and accounts receivable, CFOs need to ensure that the person responsible for paying bills cannot also enter invoices. In other words, it is the exact opposite of accounts payable and represents monies owed by customers to a business for goods or services delivered on credit. Receivables, as they’re called, are essentially an installment plan a business extends, and each has its own terms that require when payment is due and if interest or late fees will be assessed. The length of time to pay can be anywhere from a few days to a fiscal year. Most companies operate by allowing a portion of their sales to be on credit.

Usually the credit period is short, ranging from few days to months or in some cases maybe a year. On the individual-transaction level, every invoice is payable to one party and receivable to another party. If the client pays as agreed, the team records the payment as a deposit; at that point, the account is no longer receivable.

In accounting, accounts payable and accounts receivable are opposites. When Company A buys services from Company B, Company B will send them a bill. Company A owes money, so they will record this debt in their accounts payable column. While Company B waits to receive the money, they will record the bill in their accounts receivable records. In that case, the money would still be owed, and the company would be out the money.

When it becomes clear that an account receivable won’t get paid by a customer, it has to be written off as abad debt expense or one-time charge. Accounts receivable are an important aspect of a business’s fundamental analysis. Accounts receivable are a current asset, so it measures a company’s liquidity or ability to cover short-term obligations without additional cash flows.

Examples of AP and AR

Get your business on track today and enjoy the beneifts of a clean receivables system. One beneift of hiring anoutsourced bookkeeping service is getting help with receivables. Now you can focus on your work while Ignite Spot manages the data. Once the invoices are sent out, we can also help you with collections. Accounts receivable should always appear as an asset on a balance sheet. This is because we are recognizing that we paid less for the inventory that we received.

If a company has receivables, this means that it has made a sale on credit but has yet to collect the money from the purchaser. Essentially, the company has accepted a short-term IOU from its client. AP includes all open bills that need to be paid by a business in the short term for goods, services, or utilities. This means accounts payable are listed as liabilities on your balance sheet.

They need to be able to assess risk and make decisions that will protect the company’s financial interests. CFOs also need to effectively communicate with the accounting department and other stakeholders about the accounts receivable status and any policy or procedure changes. Once a company delivers goods or services to the client, the AR team invoices the customer and records the invoiced amount as an account receivable, noting the terms.

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

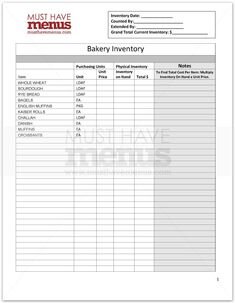

Our industry leading practices of organizing your receivables, helps you concentrate on the core operations of your business. Most businesses allow their customers to pay for goods or services over time, which means that these receivables can build up over time. This can be a good thing, as it can provide a source of working capital for the company. However, if accounts receivable become too high, it can strain the company’s cash flow.

When Keith gets your invoice, he’ll record it as an accounts payable in his general ledger, because it’s money he has to pay someone else. Stop wasting your valuable time chasing after your customers, we have a large team to input and issue invoices and receipts, follow up with your customers for payment, update AR listings. We offer the best-in-class accounts receivable service to accelerate your money collection.

„Likvido has lifted a giant weight off my shoulders and freed up my time so I can focus on earning the money and working with clients.“ „I highly recommend Likvido to any small business. I have valued the ease of working with my bookkeeper and being organized when it comes to my business finances.“ Unless you work in accounting, you might not understand exactly what the words “account receivable” actually mean.. To explain why, let’s quickly define AR, assets, and liabilities.

In this article, we’ll help you better understand how to fill out your https://bookkeeping-reviews.com/ sheet, and more specifically, where to list your accounts receivable . Bad debt can also result from a customer going bankrupt and being financially incapable of paying back their debts. One way to get people to pay you sooner is to make it worth their while. Offering them a discount for paying their invoices early—2% off if you pay within 15 days, for example—can get you paid faster and decrease your customer’s costs. If you don’t already charge a late fee for past due payments, it may be time to consider adding one. Keeping track of exactly who’s behind on which payments can get tricky if you have many different customers.